Bitcoin Outlook: BTC/USD Slides 30% From Peaks – How Much Further Could the Decline Go?

Bitcoin has now pulled back nearly 30% from its recent intraday high, despite the absence of any major news event directly triggering the drop. Traders are now focused on identifying the next key levels that could determine where the selling pressure eases.

Key Highlights

- Bitcoin is currently undergoing a −30% correction from its peak.

- Bitcoin ETFs have seen significant withdrawals, with outflows recorded on nearly every trading day this month except four, bringing total outflows close to $3 billion.

- Important downside areas to monitor include $85,600—the 78.6% retracement of the Q2–Q3 rally—and the 1-year low near $74,000.

For many in the retail trading community, Bitcoin captured mainstream attention during Thanksgiving 2017, when tech-savvy millennials excitedly explained the future of digital currency as BTC surged past the $10,000 mark. Today, Bitcoin trades at nearly nine times that value, but this year’s holiday conversations are expected to be far more subdued.

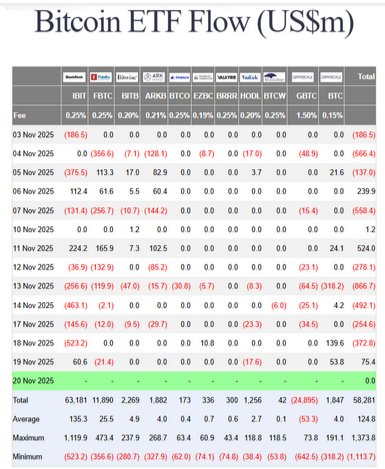

The current downturn reflects a sharp correction rather than a news-driven shock. Ironically, the launch of Bitcoin ETFs—which pushed prices higher over the last two years due to heavy institutional inflows—has now become a source of downside pressure. When sentiment turns cautious, the same large investment vehicles can reverse the trend with equally strong outflows. Data from Farside Investors shows that Bitcoin ETFs have experienced steady withdrawals throughout the month, totaling nearly –$3B to date.

Source: Farside Investors

BTC/USD Technical Picture

On the fundamental front, fading expectations of a December interest rate cut by the Federal Reserve, combined with a stronger U.S. dollar, have contributed to the selling. However, rate cut probabilities have risen slightly following the latest mixed NFP data, suggesting that macro conditions alone do not account for the broader shift in sentiment.

Bitcoin Technical Analysis: BTC/USD Daily Chart

Source: StoneX, TradingView

Bitcoin’s momentum has clearly rolled over. After reaching a fresh all-time high above $126,000 in early October, the cryptocurrency has tumbled more than 30%, recently slipping below $89,000. The decline has intensified lately, with roughly 17% of the move occurring in the last nine days.

The 14-day RSI indicates oversold territory, but that does not guarantee a near-term reversal—especially since meaningful support does not appear until the 78.6% Fibonacci retracement area around $85,600. Should that level fail, traders will look toward the $74,000 region, marking the previous yearly low.

For now, market participants are likely to keep selling into minor rallies until Bitcoin breaks out of its current downward channel. Even then, a shift to bullish sentiment would likely require the formation of a clear higher low, signaling that dip buyers are returning with conviction.